SURREAL ECONOMICS OR CONCRETE SCIENCE?

|

|

|

|

When you walk through a storm Hold your head up high And don't be afraid of the dark At the end of a storm There's a golden sky And ...

SURREAL ECONOMICS OR CONCRETE SCIENCE?

|

|

|

|

Russia’s invasion of Ukraine on February 24, 2022 immediately reversed a decades-long push for globalization as NATO pushed its pledged boundaries.

Rampant inflation proved more structural than transitory as record stimulus led to inflation. This is now causing global central banks to pursue aggressive interest rate increases to tighten monetary policy as they attempt to reign in runaway prices. Good luck.

You can’t sell a NFT picture of an ape or a rock for $1M anymore.

Crypto seemed to learn nothing from the Lehman collapse, while Sam Bankerman-Fried (FTX) seems to have learned everything from the late Bernie Madoff.

Buffett took Woods out to the…Woodshed.

Value investing is cool again, and consensus looks to play defense in the first half of 2023.

WHERE IS BUFFET INVESTING?

In the months ahead our BLOG POSTS are going to walk through what we think are the most important concerns for 2023 and beyond:

Cash Flow Matters Not Earnings Multiples

Defensive vs. Cyclical Growth Asset Classes

Energy, Materials, Minerals, Arable Land and

Other Key Resource Declines

Beware of Crypto Currency and Blockchain Scams or the “Next New AI Thing”

Collapsing National Economies and Currencies Events

For sure, it’s now all about rates and what their knock-on effects are. In 2022, the impact that rates had was most heavily felt in financial markets.

For equities (e.g. NASDAQ, et al) - it was the effect of a total multiple collapse amongst the growth names that saw the unprofitable tech basket wipe 60-90% off their values. Taking a basket of high-growth software companies, they started the year off trading at an average of 35x EV/Revenue and now trade at 7x. That is a massive collapse of confidence in growth.

In the fixed-income market - over the last decade, we were in an environment of “There is No Alternative” and now we are in a market where “There are Many Alternatives”. As rates increased, bond prices got crushed to the point where they put up the second worst year ever on record, (you have to go back to the Great Depression to get #1)

However, you can now find yield everywhere across credit and bond markets instead of having to fish into the nefarious barrel of the red-hot alternatives of scam and criminal markets. As more capital crowds around fixed income markets, lighter volume in equities and crypto hoaxes will cause higher volatility making for a bumpy ride this year.

Of course, rates do not exist in a vacuum and are a global central bank tool used to navigate exogenous factors, but it helps us frame how the reactive policies dictate our investment profiles and keeping in mind that above all else:

Nature Bats Last and thus humanity cannot defeat the physical outcomes of Exponential Mathematics.

A lot of ETF and factor people will proclaim that this was the year of value investing and that value investing is back. What they’re really trying to say is that operating margins and cash flow matter, and we couldn’t agree more.

Or else...

EDITOR'S NOTE

Last week the population of the planet surpassed eight billion people thereby doubling in number over the past fifty years. As a consequence we have grown the ecological, climate, resources, economic and agricultural food impacts by similar degrees. Consider for example, oil and natural gas that have expected reserves of 47 and 53 years, respectively, based on current global per capita consumption. So what happens when we double the population over the next fifty years?

Without factoring in the laws of diminishing returns these reserves may only last 25 years or less. Then what? Society will have no dependable sources of energy - as fossil fuels now provide more than 80 percent of the global energy needs and there are no practical alternatives. Renewable energy sources cannot meet the needs or replace them because they are too intermittent and have storage limitations. Moreover, they negatively affect the biosphere and will use up the precious arable land needed to feed the billions of new and hungry mouths.

In the final analysis, if there is any hope for a sustainable human society we need to stop doubling the population every 5o years, and learn how to Degrowth economic activity and contract population levels.

Otherwise, we will be joining those other species in the Sixth Extinction Hall of Shame in fairly short order.

Executive Committee

November 25,2022

November 21, 2022

Politicians and economists talk glowingly about growth. They want our cities and GDP to grow. Jobs, profits, companies, and industries all should grow; if they don’t, there’s something wrong, and we must identify the problem and fix it. Yet few discuss doubling time, even though it’s an essential concept for understanding growth.

Doubling time helps us grasp the physical meaning of growth—which otherwise appears as an innocuous-looking number denoting the annual rate of change. At 1 percent annual growth, any given quantity doubles in about 70 years; at 2 percent growth, in 35 years; at 7 percent, in 10 years, and so on. Just divide 70 by the annual growth rate and you’ll get a good sense of doubling time. (Why 70? It’s approximately the natural logarithm of 2. But you don’t need to know higher math to do useful doubling-time calculations.)

REAL IMPACT OF EXPONENTIALS POPULATION AND ENERGY

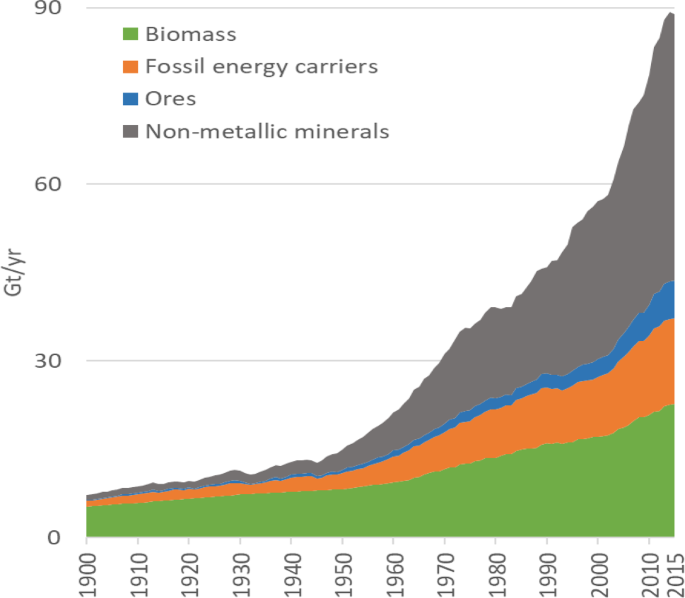

Here’s why failure to think in terms of doubling time gets us into trouble. Most economists seem to believe that a 2 to 3 percent annual rate of growth for economies is healthy and normal. But that implies a doubling time of roughly 25 years. When an economy grows, it uses more physical materials—everything from trees to titanium. Indeed, the global economy has doubled in size in the last quarter-century, and so has total worldwide extraction of materials. Since 1997 we have used over half the non-renewable resources extracted since the origin of humans.

As the economy grows, it also puts out more waste. In the last 25 years, the amount of solid waste produced globally has soared from roughly 3 million tons per day to about 6 million tons per day.

OVERPOPULATION, ENERGY, CLIMATE

COLLAPSE