Housing Breaks People’s Brains

anyone who’s been in a dumb recurring fight knows that the entire problem could be cleared up if everyone could just agree on exactly what was said or done. But you can’t, so you end up stuck in a cycle of relitigation. Housing-policy discussions are like that. They descend into crushing bickering because even the basic facts are up for debate.

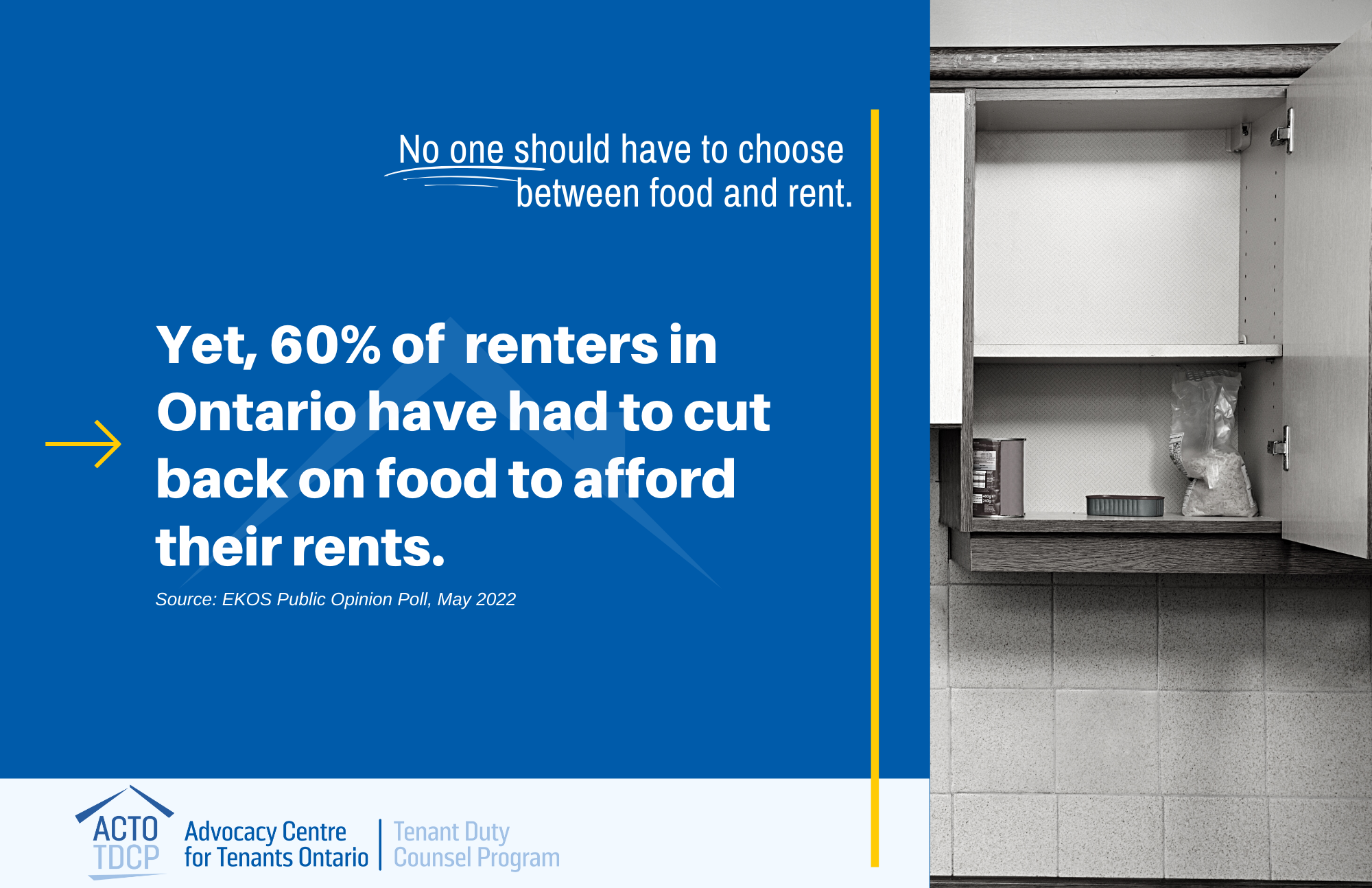

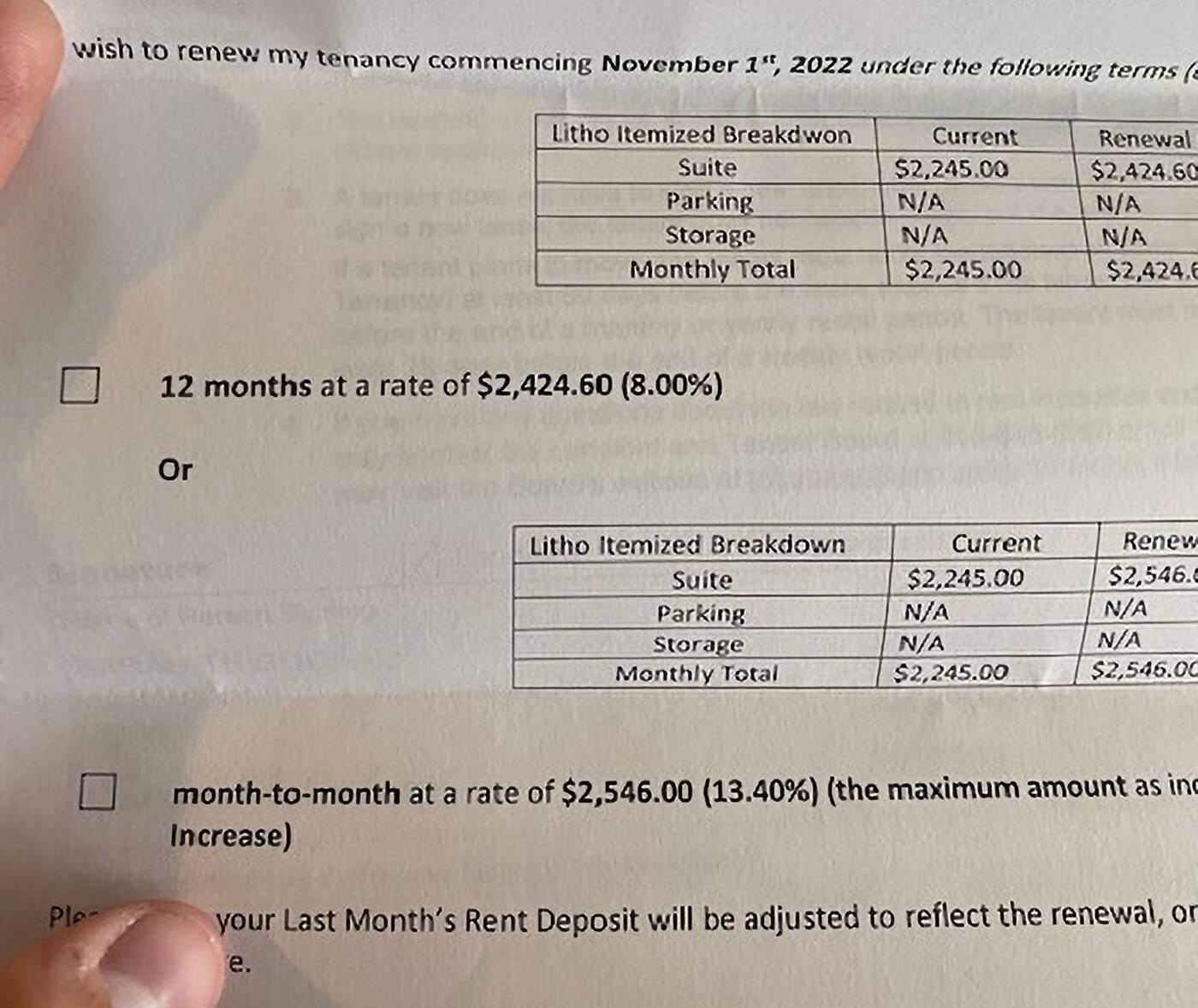

The most basic fact about the housing crisis is the supply shortage. Yet many people deny this reality. Before I get to the veritable library of studies, our personal experiences compel us to recognize that housing scarcity is all around us. The most dire signs of a shortage are when even rich people struggle to find homes. Viral clips of hundreds of yuppies lining up to tour a single Manhattan apartment or stories of real-estate agents acting as bouncers at open houses to keep things orderly—these vivid examples demonstrate that demand has far outstripped supply.

HOUSING ND MENTAL HEALTH

'TORONTO NEEDS MORE HOUSING THAN ANYONE CAN IMAGINE'

- Woodgreen Tenants' Association

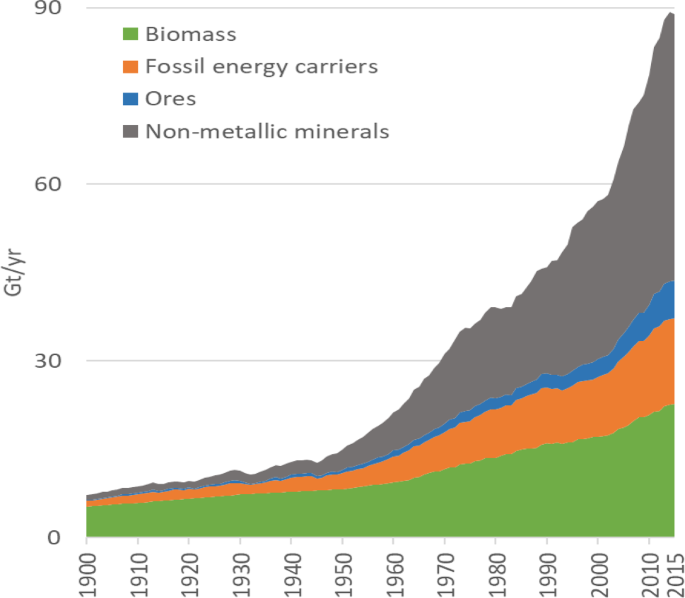

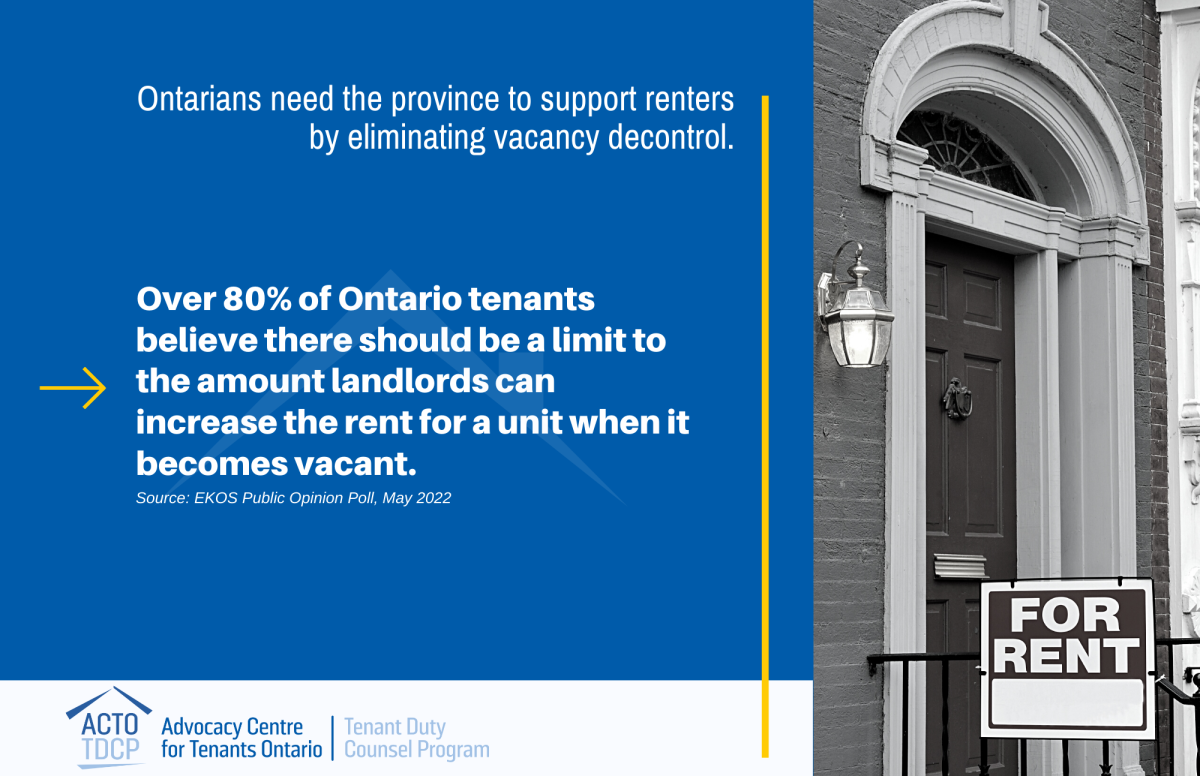

Once you accept the existence of a housing shortage, the obvious policy response is to build a bunch of homes. Research looking at San Francisco, New York, Boston, and 52,000 residents across 12 U.S. metropolitan areas have all found that new housing brings down prices. This research makes intuitive sense: If new housing is built, most of the people who move in first vacate other units. Those units then become available to newcomers, and so on. Solving a supply problem is of course harder than making the number of homes equal the number of people—different people want different sorts of homes—but the fundamental point is that we need more homes near good jobs and schools, and that give people access to the communities and amenities that make life more enjoyable.

Despite the avalanche of agreement from experts, the general public still doubts cause and effect. A new study from a trio of professors at the University of California (Clayton Nall, Chris Elmendorf, and Stan Oklobdzija) reveals that shortage denialism is not the only missing “shared fact” plaguing housing discourse. The researchers ran two nationwide surveys of urban and suburban residents and found that 30 to 40 percent of Americans believe, “contrary to basic economic theory and robust empirical evidence,” that if a lot of new housing were built in their region, then rents and home prices would rise. This posture is referred to as “supply skepticism.”

HOUSING CRISIS: DO NOT FORGET THE IMPACT ON CHILDRENS' HEALTH